This blog references an interview published in Wealth Tech Today | by Craig Iskowitz | January 13, 2022

For many wealth management firms, the thought of platform consolidation seems like an elusive Holy Grail. The rewards of efficiency and consistency across multiple investment programs looms large, but there are many pitfalls along the way. Recently MyVest CEO Anton Honikman sat down with Craig Iskowitz of Wealth Tech Today to discuss the steps to pursue the ideal platform for firms, advisors and, most importantly, clients.

How do you define the Holy Grail of platform consolidation?

First it’s helpful to describe what platform consolidation isn’t. Platform consolidation is not a utopian ideal of a single advisory platform that does everything. Platform consolidation still leaves scope for specialists in particular fields to integrate with a core platform, for example financial planning and CRM.

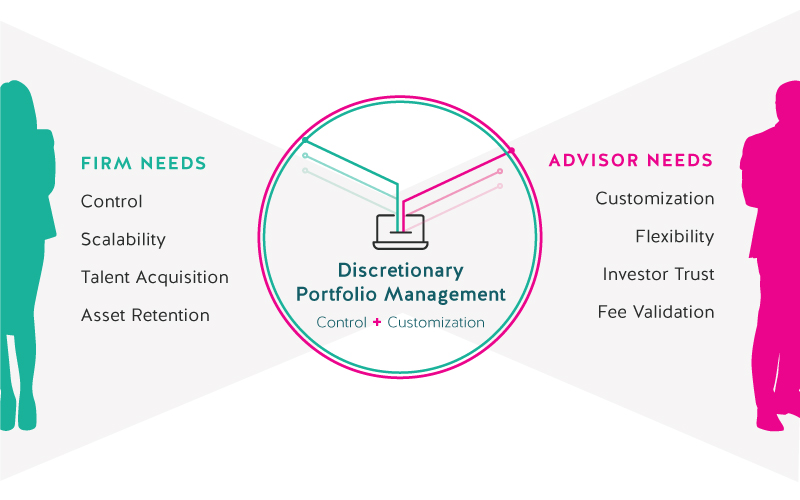

What platform consolidation is, is a unified chassis for all managed investment solutions. In other words, the ideal is a single platform from which managed accounts can be manufactured and delivered, irrespective of the program, including for example UMA, Rep-as-PM, or MF/ETF Wrap.

What are some of the characteristics of the ideal target platform?

The four key characteristics of the ideal target for managed accounts platform consolidation are (1) multi custodial, (2) ability to configure and share discretion between the home office and the advisor, (3) a robust API infrastructure and (4) cloud compatibility.

What are the challenges of platform consolidation?

There’s the challenge of execution risk. There’s a lot of wiring and rewiring complexity, legacy displacement, and onboarding of new tools.

Often under-appreciated is the concept of horizon risk. The duration of large platform consolidation projects can often exceed budget cycles and the evaluation period of the sponsoring executives.

Another headwind is the challenge of change management. There’s training, buy-in, adoption and sometimes vested interests in legacy platforms, all of which must be overcome.

How do you address these headwinds?

To mitigate these challenges I recommend that firms consider the path to the target operating model in phases. This allows for smaller milestones with managed execution risk that can be delivered within budget cycles. It also enables the sponsoring team to generate early wins, which in turn supports credibility and buy-in, smoothing out the change agenda.

In addition to the target state platform, the current state should be mapped so that you can chart a course, identifying those smaller milestones along the way.

By all means, avoid the single big bang cutover.

What are the rewards?

The rewards are removing redundancy, streamlining processes, reducing costs and reducing risk to the firm. If you don’t do platform consolidation, you could risk attrition of clients and/or advisors and obsolescence in terms of your business model. Also there is an opportunity to unlock new business models and managed account programs.

What are the drivers and catalytic conditions for change?

One catalyst could be that legacy platforms do not support modern business models. For example, legacy platforms that don’t support tax optimization or shared discretion between advisors and the home office, may not support a firm’s future.

Have you helped your customers go through this process?

Yes, more than once. Notably, at one of our long-standing customers, we deployed a multi-custodial solution — a centralized mass-affluent UMA program, a high-net-worth Rep-as-PM style bank trust solution, and an automated digital wealth program, all on the same stack. Three completely different programs on different custodians, on a common stack, each configured differently.

Risk was mitigated by not going for a big bang. Even when the target platform was ready they gradually migrated groups of advisors over to the new platform. They built early success, internal proponents who trained others and in so doing built demand and thus adoption and a self-fulfilling cycle.

In the Cerulli Edge—U.S. Managed Accounts Edition, 3Q 2021 Issue, they conducted a survey that found platform consolidation — however you define it — is high on the list of priorities, and that a majority of firms plan to or have already integrated their managed account programs onto a single architecture. It is hard, it takes time, but it’s happening and it’s worth it!

* This is a reference to the classic 1975 British comedy, Monty Python and the Holy Grail, where their quest for an elusive golden chalice proved to be ultimately unattainable with many challenges along the way. Somewhat instructive for the pursuit of wealth management platform consolidation, perhaps?

![MyVest CEO Sees a Tech-Enabled Future Rapidly Approaching [PlanAdviser]](https://myvest.com/wp-content/uploads/PlanAdvisor-Anton-interview-May-2021.jpg)

![We Can Do Better: Making Financial Wellness a Workplace Imperative [BenefitsPRO]](https://myvest.com/wp-content/uploads/MyVest-FacetWealth-financial-wellness.jpg)