This blog is part 2 of 3 based on our research paper, “Control vs. Customization in Wealth Management: Advisor Discretion Doesn’t Have to be a Zero-Sum Game.” (Read part 1 here.)

Control is always a delicate dance. As a wealth management firm, you want to have a handle on your business, but also give your advisors the space and support they need to find success for their clients.

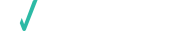

Central to the tension and trade-offs firms face when designing more competitive Discretionary Portfolio Management (DPM) programs is: “How do we balance advisor customization with firm oversight?” The failure to get this mix right is potentially disastrous to any firm.

Balancing the demand for customization with the need for control

In order to deliver the most competitive investment platform to discretionary advisors, home offices need to enable just enough flexibility to win (or keep) top advisor teams while still protecting the firm and its clients by ensuring compliance rules are appropriately set and followed.

Based on the interviews we conducted for this research, we’ve identified the most common factors firms use to strive for this balance:

Light Oversight with High Accreditation Standard

Some firms pushed advisors to qualify for the DPM program with such high standards that the oversight/control function was little more than weekly compliance reporting. These firms appeared to rely on the advisor’s CFA standard and technology training to stay on the rails. Noticeably, these were smaller firms that were growing their DPM business.

Flexibility from a Set Menu of Options

Another approach ensured that the assets in client portfolios were from a well-vetted firm-approved list, but advisors were given very little oversight as to how and when those assets were deployed. Oversight from IPS or drift reporting were available, but not universally enforced. This model was more common at larger regional bank-based wealth firms.

Limited Flexibility within Firm Guardrails

We found the “limited flexibility” model to be the most common, which includes established client investment objectives, allocation ranges and a set of approved assets/strategies to select from. In most cases, these programs were well-honed from a long history with the DPM approach and had higher levels of automation for monitoring, rebalancing, trading, alerts and varying levels of integration.

Decentralized Overlay

Possibly the most compelling model for advisors is where an advisor’s own models are reviewed and approved by the home office, then automated into the monitoring and rebalancing systems for easy management. For advisors who have defined strategies and a defensible approach to investing for their clients, this works. However, the application of those models will be constrained to fairly tight guardrails, which can stifle customization.

Accreditation

Regardless of which model, all firms we interviewed used an accreditation process to control who had access to the really sharp tools. As a 2017 Money Management Institute report observed “advisors must meet a number of criteria before being approved by their firms to conduct DPM business. There is typically a minimum educational level for advisors, such as receiving the CFA designation or passing an internal training program. Advisors are also required to have a certain number of years of investment experience, meet requisite asset and production hurdles and follow any firm-related portfolio construction rules. They must also, of course, have and maintain an acceptable compliance record in order to be approved for a firm’s DPM platform.”

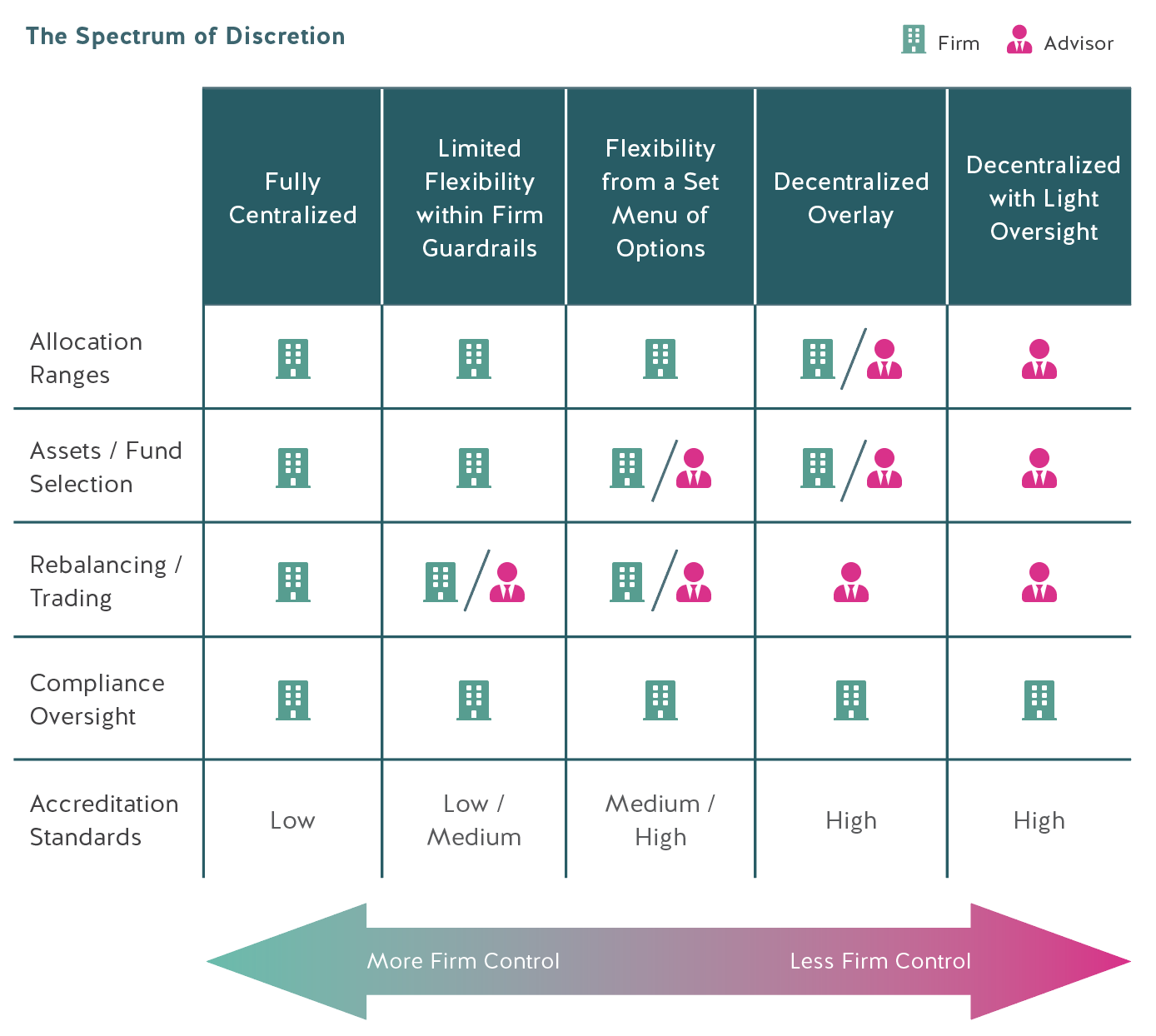

How Firms Do It: The Spectrum of Discretion

Firms can use the framework demonstrated in the matrix below to configure the roles and functions of their DPM platforms along a spectrum of discretion to achieve different levels of centralized vs. decentralized portfolio management.

In the long-term, the boundaries between advisor-driven and centrally-managed programs will blur, and all programs will exist on a spectrum with varying levels of configurable advisor discretion.

DPM will occupy an important place on that spectrum, always accompanied by some degree of centralized oversight. How that balance is struck will depend on a firm’s strategy, driven in large part by the importance of centralized standards versus the importance of advisor retention.

Stay tuned for our next entry in this series, where we’ll delve into the technology you need for a successful DPM program. Download the full research paper here.

![MyVest Byline: The Evolution of the UMA from 1.0 to 3.0 [Wealth Management]](https://myvest.com/wp-content/uploads/wealth-management-logo.webp)

![How to Diversify Your Tech Stack with FinTech Integrations [INSART interview]](https://myvest.com/wp-content/uploads/iStock-1203832818.jpg)

![MyVest CEO Sees a Tech-Enabled Future Rapidly Approaching [PlanAdviser]](https://myvest.com/wp-content/uploads/PlanAdvisor-Anton-interview-May-2021.jpg)